-

Notifications

You must be signed in to change notification settings - Fork 0

/

Copy pathpaysafeapidirectdebitv1-apiary.apib

3218 lines (2767 loc) · 182 KB

/

paysafeapidirectdebitv1-apiary.apib

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84

85

86

87

88

89

90

91

92

93

94

95

96

97

98

99

100

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

126

127

128

129

130

131

132

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

150

151

152

153

154

155

156

157

158

159

160

161

162

163

164

165

166

167

168

169

170

171

172

173

174

175

176

177

178

179

180

181

182

183

184

185

186

187

188

189

190

191

192

193

194

195

196

197

198

199

200

201

202

203

204

205

206

207

208

209

210

211

212

213

214

215

216

217

218

219

220

221

222

223

224

225

226

227

228

229

230

231

232

233

234

235

236

237

238

239

240

241

242

243

244

245

246

247

248

249

250

251

252

253

254

255

256

257

258

259

260

261

262

263

264

265

266

267

268

269

270

271

272

273

274

275

276

277

278

279

280

281

282

283

284

285

286

287

288

289

290

291

292

293

294

295

296

297

298

299

300

301

302

303

304

305

306

307

308

309

310

311

312

313

314

315

316

317

318

319

320

321

322

323

324

325

326

327

328

329

330

331

332

333

334

335

336

337

338

339

340

341

342

343

344

345

346

347

348

349

350

351

352

353

354

355

356

357

358

359

360

361

362

363

364

365

366

367

368

369

370

371

372

373

374

375

376

377

378

379

380

381

382

383

384

385

386

387

388

389

390

391

392

393

394

395

396

397

398

399

400

401

402

403

404

405

406

407

408

409

410

411

412

413

414

415

416

417

418

419

420

421

422

423

424

425

426

427

428

429

430

431

432

433

434

435

436

437

438

439

440

441

442

443

444

445

446

447

448

449

450

451

452

453

454

455

456

457

458

459

460

461

462

463

464

465

466

467

468

469

470

471

472

473

474

475

476

477

478

479

480

481

482

483

484

485

486

487

488

489

490

491

492

493

494

495

496

497

498

499

500

501

502

503

504

505

506

507

508

509

510

511

512

513

514

515

516

517

518

519

520

521

522

523

524

525

526

527

528

529

530

531

532

533

534

535

536

537

538

539

540

541

542

543

544

545

546

547

548

549

550

551

552

553

554

555

556

557

558

559

560

561

562

563

564

565

566

567

568

569

570

571

572

573

574

575

576

577

578

579

580

581

582

583

584

585

586

587

588

589

590

591

592

593

594

595

596

597

598

599

600

601

602

603

604

605

606

607

608

609

610

611

612

613

614

615

616

617

618

619

620

621

622

623

624

625

626

627

628

629

630

631

632

633

634

635

636

637

638

639

640

641

642

643

644

645

646

647

648

649

650

651

652

653

654

655

656

657

658

659

660

661

662

663

664

665

666

667

668

669

670

671

672

673

674

675

676

677

678

679

680

681

682

683

684

685

686

687

688

689

690

691

692

693

694

695

696

697

698

699

700

701

702

703

704

705

706

707

708

709

710

711

712

713

714

715

716

717

718

719

720

721

722

723

724

725

726

727

728

729

730

731

732

733

734

735

736

737

738

739

740

741

742

743

744

745

746

747

748

749

750

751

752

753

754

755

756

757

758

759

760

761

762

763

764

765

766

767

768

769

770

771

772

773

774

775

776

777

778

779

780

781

782

783

784

785

786

787

788

789

790

791

792

793

794

795

796

797

798

799

800

801

802

803

804

805

806

807

808

809

810

811

812

813

814

815

816

817

818

819

820

821

822

823

824

825

826

827

828

829

830

831

832

833

834

835

836

837

838

839

840

841

842

843

844

845

846

847

848

849

850

851

852

853

854

855

856

857

858

859

860

861

862

863

864

865

866

867

868

869

870

871

872

873

874

875

876

877

878

879

880

881

882

883

884

885

886

887

888

889

890

891

892

893

894

895

896

897

898

899

900

901

902

903

904

905

906

907

908

909

910

911

912

913

914

915

916

917

918

919

920

921

922

923

924

925

926

927

928

929

930

931

932

933

934

935

936

937

938

939

940

941

942

943

944

945

946

947

948

949

950

951

952

953

954

955

956

957

958

959

960

961

962

963

964

965

966

967

968

969

970

971

972

973

974

975

976

977

978

979

980

981

982

983

984

985

986

987

988

989

990

991

992

993

994

995

996

997

998

999

1000

FORMAT: 1A

HOST: https://api.test.paysafe.com/directdebit/

# Paysafe Direct Debit API

# Release Notes

| Version | Date | Details |

|--- |--- |--- |

| 1.0 | April 2018 | <ul><li>Changed "turnkey" to "platforms"</li></ul>|

| 1.0 | December 2017 | <ul><li>Added Direct Debit single-use tokens</li></ul>|

| 1.0 | November 2016 | <ul><li>Document release</li></ul> |

# Overview

Connect your application with the Paysafe payment engine through our RESTful API and access a full suite of methods, including Purchases and Standalone Credits.

* Obtain output in JSON format that’s easily parsed by wide range of Web and mobile applications.

* Use any language or platform to make requests through standard HTTP protocols.

**Start accepting Direct Debit payments**

Once you have set up a Paysafe merchant account, you can connect to the Paysafe gateway with our simple-to-use API.

Here is a summary of the process:

1. You send a transaction request, including bank information and purchase amount.

2. Paysafe processes the request.

3. The transaction is completed in real time, though in most cases the request clears in 3–5 business days, at which time payment will be deposited in your business bank account.

4. You can look up any Direct Debit transaction you have processed with Paysafe, including charges and credits.

**Direct Debit workflow**

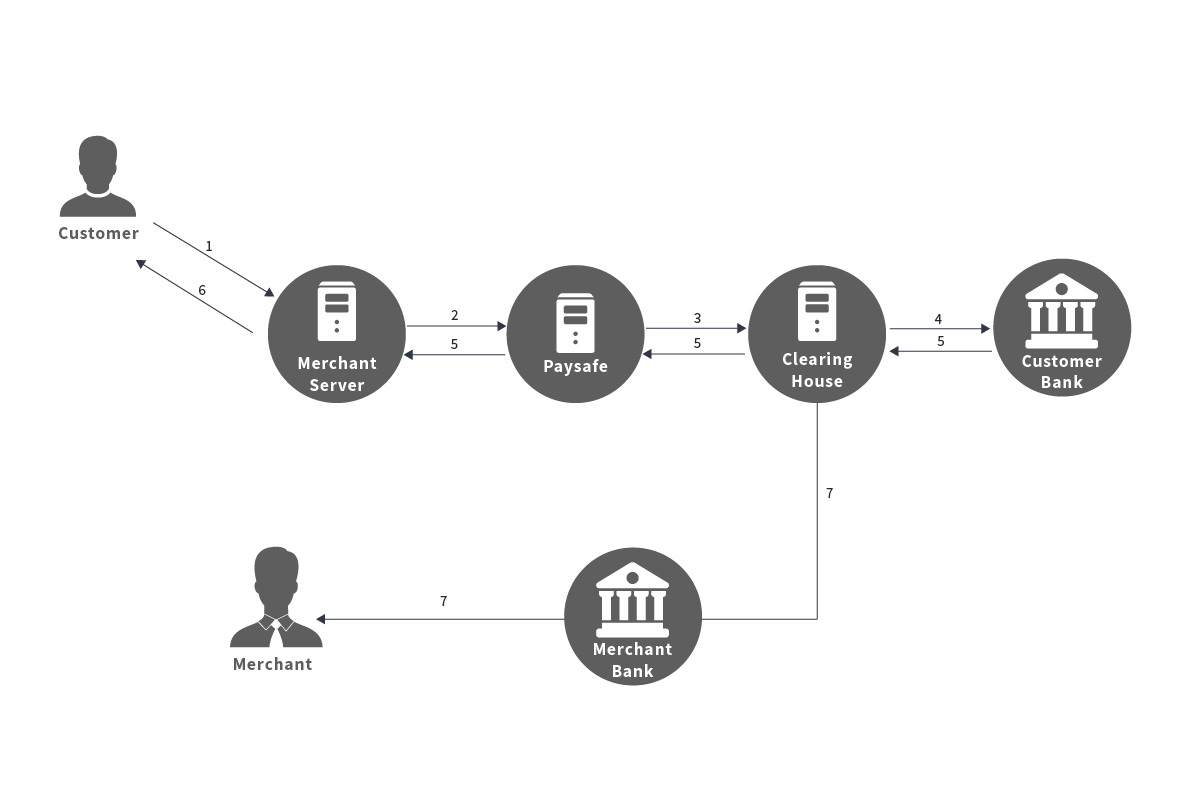

The flow of funds in a Direct Debit charge transaction is depicted in the diagram below.

1. The customer places an order on the merchant's website.

2. The merchant securely transfers the order information (including bank information and purchase amount) to Paysafe. Note that for certain bank schemes, a mandate reference number must be included in the request.

3. Paysafe sends the transaction request to a Direct Debit clearing house.

4. The Direct Debit charge request is routed to the customer's bank. At this point, the bank information is verified.

5. The transaction is approved by the customer's bank and the approval relayed via Paysafe to the Merchant server.

6. The customer is informed of the approval.

7. The customer's bank transfers the moixedney to the merchant's bank account.

8. The transaction is completed in real time, but in most cases the request clears in 3–5 business days, by which time payment will be deposited in the merchant's business bank account. Merchants can look up any Direct Debit transaction they have processed with Paysafe, including charges and credits, using either the Direct debit API or the Paysafe Merchant Back Office.

<a name="apikey" title="Authentication"></a>

# Authentication

In order for you to use the Paysafe REST API, Paysafe must first set you up on their system

and provide you with an API key. Your API key looks something like this:

* Key Username – MerchantXYZ

* Key Password – B-tst1-0-51ed39e4-312d02345d3f123120881dff9bb4020a89e8ac44cdfdcecd702151182fdc952272661d290ab2e5849e31bb03deede7e

Note that this is not the same as your Merchant Back Office username and password.

The case-sensitive API key is sent using HTTP Basic Authentication. To use HTTP Basic Authentication, you must send the API key credentials using the Authorization header with every request. The Authorization header is constructed as follows:

1. The Key Username and Key Password are combined into a string separated by a colon, e.g.,“Key Username:Key Password”.

2. The resulting string literal is then encoded using Base64.

3. The authorization method and a space (i.e., “Basic”) are then put before the encoded string.

For example, using the Key Username and Password examples above, the header is formed as follows:

``Authorization: Basic

TWVyY2hhbnRYWVo6Qi10c3QxLTAtNTFlZDM5ZTQtMzEyZDAyMzQ1ZDNmMTIzMTIwODgxZGZmOWJiNDAyMGE4OWU4YWM0NGNkZmRjZWNkNzAyMTUxMTgyZmRjOTU yMjcyNjYxZDI5MGFiMmU1ODQ5ZTMxYmIwM2RlZWRlN2U=``

For additional details, please refer to [http://en.wikipedia.org/wiki/Basic_access_authentication](http://en.wikipedia.org/wiki/Basic_access_authentication).

**Note:** Your Production API key will be different from your Test API key. Contact your account manager for details. You must keep your API keys safe and ensure that it is used appropriately for your needs.

# URLs

## Test URL

In order to test your integration with Paysafe, use the following Test URL:

`https://api.test.paysafe.com`

For example:

`https://api.test.paysafe.com/directdebit/v1/accounts/{account_id}`

## Production URL

In order to process live requests with Paysafe, use the following Production URL:

`https://api.paysafe.com`

For example:

`https://api.paysafe.com/directdebit/v1/accounts/{account_id}`

<a name="pagination" title="Pagination"></a>

# Pagination

In the case where an API GET request returns multiple results, Paysafe returns the first 10 records by default and uses HATEOAS links to provide page navigation. In addition to the default behavior, it is also possible to control the number of results and starting point by passing in query parameters as follows:

<a name="globalinvalidcharacters" title="Global Invalid Characters"></a>

# Global Invalid Characters

You must not include any of the characters in this [table](https://developer.paysafe.com/en/resources-and-support/global-invalid-characters/) as values in any of your request parameters. If you do, your request will result in an error.

<a name="isostandards" title="ISO Standards"></a>

# ISO Standards

ISO standards add value by providing the common business process data semantics to be used in the API based exchanges. This [section](https://developer.paysafe.com/en/resources-and-support/iso-standards/) presents you codes for four areas - Currency, Province, State, and Country.

# API

The Direct Debit API allows merchants to process echeck transactions using the REST protocol. The protocol uses JSON for all requests and responses.

The following request types are supported:

* [Purchases](#purchaserequest)

* [Standalone Credits](#standalonecreditrequest)

**Note:** The availability of request types is allotted on a merchant-by-merchant basis, since not all merchant banks support all operations. If you have any questions, contact your account manager.

**API Endpoint**

`https://api.paysafe.com/directdebit/v1/accounts/{account_id}`

**Resource Patterns**

|Endpoint URL |Description |Action |

|--- |--- |--- |

|/purchases |Submit a Purchase |POST |

|/purchases/{purchase_id} |Cancel a Purchase |PUT |

|/purchases/{purchase_id} |Look Up a Purchase |GET |

|/standalonecredits |Submit a Standalone Credit |POST |

|/standalonecredits/{standalone_credit_id} |Cancel a Standalone Credit |PUT |

|/standalonecredits/{standalone_credit_id} |Look Up a Standalone Credit |GET |

<a name="gettingstarted"></a>

# Getting Started

Click [here](https://developer.paysafe.com/en/rest-apis/direct-debit/using-the-api/scenarios/) for some common scenarios for making Direct Debit payments.

# Testing Instructions

The Paysafe Test environment can be used to test websites or applications without actually running transactions through the payment processing engine. It is important to make sure that your systems are working correctly before going into a live environment. Click [here](https://developer.paysafe.com/en/rest-apis/direct-debit/test-and-go-live/testing-instructions/) for details of how to use the test environment.

# Complex JSON Objects

<a name="achobject" title="ACH Object"></a>

## ach

When providing ACH bank account information, merchants can provide either a payment token of the customer's bank account, or the bank account details.

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|paymentToken |string <br/>`length<=50` |Yes |If the payment token is provided, no other bank account information is necessary.<br/>**Note:** The payment token is the *paymentToken* value returned in the response to the ACH bank account creation request.|

|payMethod |enum |Yes |This is the payment type. <ul><li>WEB (Personal bank accounts only)</li><li>TEL (Personal bank accounts only)</li><li>PPD (Personal bank accounts only</li><li>CCD (Business bank accounts only)</li></ul><br>**Note:** Standalone Credits support only PPD and CCD.|

|paymentDescriptor |string<br/>`length<=12` | |This is the descriptor that will appear on the customer's bank statement.|

**OR**

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|accountHolderName |string <br/>`length<=22` |Yes |This is the name of the customer or company.|

|accountType |enum |Yes |This is the bank account type.<ul><li>SAVINGS</li><li>CHECKING</li><li>LOAN</li></ul>|

|payMethod |enum |Yes |This is the payment type. <ul><li>WEB (Personal bank accounts only)</li><li>TEL (Personal bank accounts only)</li><li>PPD (Personal bank accounts only</li><li>CCD (Business bank accounts only)</li></ul><br>**Note:** Standalone Credits support only PPD and CCD.|

|accountNumber |string <br/>`length=4-17` |Yes |This is the bank account number.|

|routingNumber |string<br/>`length=9` |Yes |For USD accounts, this is the 9-digit routing number of the customer's bank.|

|paymentDescriptor |string<br/>`length<=12` | |This is the descriptor that will appear on the customer's bank statement.|

|lastDigits |string<br/>`length=2` | |These are the last two digits of the bank account number, returned in the response. |

```apib

{

"ach": {

"accountHolderName": "XYZ Company",

"accountType": "CHECKING",

"accountNumber": "988772192",

"routingNumber": "211589828",

"payMethod": "WEB"

}

}

```

<a name="bacsobject" title="BACS Object"></a>

## bacs

When providing BACS bank account information, merchants can provide either a payment token of the customer's bank account, or the bank account details.

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|paymentToken |string <br/>`length<=50` |Yes |If the payment token is provided, no other bank account information is necessary.<br/>**Note:** The payment token is the *paymentToken* value returned in the response to the BACS bank account creation request.|

**OR**

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|accountHolderName |string <br/>`length<=18` |Yes |This is the name of the customer or company.|

|sortCode |string<br/>`length=6` |Yes |This is the sort code for the customer's bank account.|

|accountNumber |string <br/>`length=8` |Yes |This is the bank account number.|

|mandateReference |string<br/>`length=10` |Yes |This is the *reference* element used in the mandate creation request. It is the identifier of the mandate in the banking system.|

|lastDigits |string<br/>`length=2` | |These are the last two digits of the bank account number, returned in the response. |

```apib

{

"bacs": {

"accountHolderName": "XYZ Company",

"sortCode": "321654",

"accountNumber": "98877219",

"mandateReference": "SUBSCRIP10"

}

}

```

<a name="billingdetailsobject" title="Billing Details Object"></a>

## billingDetails

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|street |string<br/>`length<=50` | |This is the first line of the street address in the billing address.|

|street2 |string<br/>`length<=50` | |This is the second line of the street address in the billing address, if required (e.g., apartment number).|

|city |string<br/>`length<=40` | |This is the city in the billing address.|

|state |string<br/>`length<=40` | |Use the 2-character state or province codes for Canada or the United States.|

|country |enum <br/>`length<=2` | |See [Country Codes](#countrycodes).|

|zip |string<br/>`length<=10` | |This is the postal/zip code in the billing address.|

|phone |string<br/>`length<=40` | |This is the customer's telephone number.|

```apib

{

"billingDetails":{

"street":"100 Queen Street West",

"city":"Toronto",

"state":"ON",

"country":"CA",

"zip":"M5H 2N2"

}

}

```

<a name="dateofbirthobject" title="Date of Birth Object"></a>

## dateOfBirth

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|day |number<br/>`length=2 max=31` |Yes |This is the day of the customer’s birth.|

|month |number<br/>`length=2 max=12` |Yes |This is the month of the customer’s birth.|

|year |string<br/>`length=4 min=1900` |Yes |This is the year of the customer’s birth.|

```apib

{

"dateOfBirth": {

"day": 15,

"month": 9,

"year": 1968

}

}

```

<a name="eftobject" title="EFT Object"></a>

## eft

When providing EFT bank account information, merchants can provide either a payment token of the customer's bank account, or the bank account details.

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|paymentToken |string <br/>`length<=50` |Yes |If the payment token is provided, no other bank account information is necessary.<br/>**Note:** The payment token is the *paymentToken* value returned in the response to the EFT bank account creation request.|

|paymentDescriptor |string<br/>`length<=15` | |This is the descriptor that will appear on the customer's bank statement.|

**OR**

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|accountHolderName |string <br/>`length<=30` |Yes |This is the name of the customer or company.|

|accountNumber |string <br/>`length=4-12` |Yes |This is the bank account number.|

|transitNumber |string<br/>`length=5` |Yes |This is the 5-digit transit number of the customer's bank branch.|

|institutionId |string<br/>`length=3` |Yes |This is the 3-digit institution ID of the customer’s bank branch.|

|paymentDescriptor |string<br/>`length<=15` | |This is the descriptor that will appear on the customer's bank statement.|

|lastDigits |string<br/>`length=2` | |These are the last two digits of the bank account number, returned in the response. |

```apib

{

"eft": {

"accountHolderName": "XYZ Company",

"accountNumber": "336612",

"transitNumber": "22446",

"institutionId": "001"

}

}

```

<a name="errorobject" title="Error Object"></a>

## error

|Element |Type |Description |

|--- |--- |--- |

|code |string |The error code. Also shown in the X-Application-Status-Code response header. |

|message |string |A description of the error. |

|details |string array |Details of any parameter value errors (optional). |

|links |string array |One or more rel/href pairs, where rel is "errorinfo", and href is the Developer Center URL containing a description of the error.|

```apib

{

"error":{

"code":"5016",

"message":"The merchant account submitted with your request could not be found",

"details":[

"Account 89983659 does not exist"

],

"links":[

{

"rel":"errorinfo",

"href":"https://developer.optimalpayments.com/en/documentation/direct-debit-api/error-5016"

}

]

}

}

```

<a name="linksobject" title="Links Object"></a>

## links

|Element |Type |Required |Description|

|--- |--- |--- |---|

|rel |string |Required |This is the link type that allows different endpoints to be targeted depending on the end state of the transaction.|

|href |string |Required |This is the URI of the resource.|

```apib

{

"links": [

{

"rel": "self",

"href": "https://api.paysafe.com/directdebit/v1/accounts/1001058140/purchases/a02e52c7-c991-4418-966a-b62989cb0eae"

}

],

}

```

<a name="profileobject" title="Profile Object"></a>

## profile

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|firstName |string<br/>`length<=80` |Yes |This is the customer’s first name.|

|lastName |string<br/>`length<=80` |Yes |This is the customer’s last name.|

|email |string<br/>`length<=255` | |This is the customer’s email address.|

|ssn |string<br/>`length<=9` | |This is the customer's social security number.|

|dateOfBirth |[dateOfBirth](#dateofbirthobject) | |This is the customer's date of birth.|

```apib

{

"profile": {

"firstName": "Joe",

"lastName": "Smith",

"email": "[email protected]",

"ssn": "123456789",

"dateOfBirth": {

"day": 15,

"month": 9,

"year": 1968

}

}

}

```

<a name="purchaseobject" title="Purchase Object"></a>

## purchase

|Element |Type |Description |

|--- |--- |--- |

|id |string <br/>`length<=36` |This is the ID returned in the response. This ID can be used for future associated requests, e.g., Purchase lookup.|

|merchantRefNum |string <br/>`length<=255` |This is the merchant reference number created by the merchant and submitted as part of the request. It must be unique for each request.|

|amount |number<br>`max=99999999999` |This is the amount of the request, in minor units. For example, to process US $10.99, this value should be 1099. To process 1000 Japanese yen, this value should be 1000. To process 10.139 Tunisian dinar, this value should be 10139.<br/>**Note:** If the merchant account is set up for a currency that has 3 decimal units, our system will half round up the least significant digit. Therefore, a transaction of 10.139 Tunisian dinar would be processed as 10.14.|

|ach |[ach](#achobject) |These are the details of the bank account used.|

|eft |[eft](#eftobject) |These are the details of the bank account used.|

|bacs |[bacs](#bacsobject) |These are the details of the bank account used.|

|sepa |[sepa](#sepaobject) |These are the details of the bank account used.|

|profile |[profile](#profileobject) |These are some details about the customer. |

|billingDetails |[billingDetails](#billingdetailsobject)|These are the billing details for the request.|

|customerIp |string<br/>`length<=39` |This is the customer's IP address.|

|dupCheck |boolean |This validates that this request is not a duplicate. A request is considered a duplicate if the *merchantRefNum* has already been used in a previous request within the last 90 days.<br/>**Note:** This value defaults to *true*.|

|txnTime |UTC formatted date |This is the date and time the request was processed. For example:<br/>2017-01-26T10:32:28Z|

|currencyCode |string<br/>`length=3` |This is the currency of the merchant account, e.g., USD or GBP, returned in the request response. See [Currency Codes](#currencycodes)|

|error |[error](#errorobject) | |

|status |enum |This is the status of the transaction request. Possible values are:<ul><li>RECEIVED – Our system has received the request and is waiting for the downstream processor’s response.</li><li>PENDING – Our system has received the request but it has not yet been batched.</li><li>PROCESSING – The batching has started.</li><li>COMPLETED – The transaction has been completed.</li><li>FAILED – The transaction failed, due to either an error or being declined.</li><li>CANCELLED – The request has been cancelled.</li></ul>|

|splitpay |[splitpay](#splitpayobject) |This enables you to use Split Payouts functionality when processing a purchase.|

<a name="sepaobject" title="SEPA Object"></a>

## sepa

When providing SEPA bank account information, merchants can provide either a payment token of the customer's bank account, or the bank account details.

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|paymentToken |string <br/>`length<=50` |Yes |If the payment token is provided, no other bank account information is necessary.<br/>**Note:** The payment token is the *paymentToken* value returned in the response to the SEPA bank account creation request.|

**OR**

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|accountHolderName |string <br/>`length<=32` |Yes |This is the name of the customer or company.|

|iban |string<br/>`length=1-34` |Yes |This is the International Bank Account Number for the customer's bank account.|

|mandateReference |string<br/>`length=35` |Yes |This is the *reference* element used in the mandate creation request. It is the identifier of the mandate in the banking system. <br/>**Note:** This element is not required for SEPA standalone credits.|

|lastDigits |string<br/>`length=2` | |These are the last two digits of the bank account number, returned in the response. |

|bic |string<br/>`length=8-11` | |This is the Bank Identifier Code for the customer's bank account.|

```apib

{

"sepa": {

"mandateReference": "1000-3232659874-65985698",

"accountHolderName": "XYZ Company",

"iban": "NL77ABNA0492122466"

}

}

```

<a name="shippingdetailsobject" title="Shipping Details Object"></a>

## shippingDetails

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|carrier |enum | |This is the shipment carrier. Possible values are:<ul><li>APC – APC Overnight</li><li>APS – Anpost</li><li>CAD – Canada Postal Service</li><li>DHL – DHL</li><li>FEX – Fedex</li><li>RML – Royal Mail</li><li>UPS – United Parcel Service</li><li>USPS – United States Postal Service</li><li>CLK – CityLink</li><li>EMS – EMS (US Postal Service)</li><li>NEX – Nexworldwide</li><li>OTHER</li></ul>|

|shipMethod |enum | |This is the method of shipment. Possible values are:<ul><li>T – Next Day/Overnight</li><li>T – Two-Day Service</li><li>C – Lowest Cost</li><li>O – Other</li></ul>|

|recipientName |string<br/>`length<=255` | |This is the name of the person receiving the goods.|

|street |string<br/>`length<=50` | |This is the recipient's street address.|

|street2 |string<br/>`length<=50` | |This is the second line of the street address in the shipping address, if required (e.g., apartment number).|

|city |string<br/>`length<=40` | |This is the city in which the recipient resides.|

|state |string | |See [Province Codes](#provincecodes) or [State Codes](#statecodes) for Canada or the United States.|

|country |enum | |See [Country Codes](#countrycodes). |

|zip |string<br/>`length<=40` | |This is the the recipient's postal/zip code.|

```apib

{

"shippingDetails":{

"carrier":"UPS",

"shipMethod":"N",

"street":"100 Broadway",

"city":"Sacramento",

"state":"CA",

"country":"US",

"zip":"94203"

}

}

```

<a name="splitpayobject"></a>

## splitpay

|Element |Type |Required |Description |

|--- |--- |--- |--- |

|linkedaccount |string |Yes |This is the ID of the linked account.

|amount |number | |The amount to transfer to the linked account in minor currency units. Either this or percent must be specified.|

|percent |number | |This is the percentage of the total transaction amount to transfer to the linked account, to two decimal places. The total percentage to all linked accounts cannot exceed 100%. Either this or amount must be specified.|

```apib

{

"splitpay": [

{

"linkedAccount": "123124124",

"percent": 5

},

{

"linkedAccount": "767862873",

"amount": 500

}]

}

```

<a name="standalonecreditobject" title="Standalone Credit Object"></a>

## standalonecredit

|Element |Type |Description |

|--- |--- |--- |

|id |string <br/>`length<=36` |This is the ID returned in the response. This ID can be used for future associated requests, e,g., Standalone Credit lookup.|

|merchantRefNum |string <br/>`length<=255` |This is the merchant reference number created by the merchant and submitted as part of the request. It must be unique for each request.|

|amount |number<br>`max=99999999999` |This is the amount of the request, in minor units.For example, to process US $10.99, this value should be 1099. To process 1000 Japanese yen, this value should be 1000. To process 10.139 Tunisian dinar, this value should be 10139.<br/>**Note:** If the merchant account is set up for a currency that has 3 decimal units, our system will half round up the least significant digit. Therefore, a transaction of 10.139 Tunisian dinar would be processed as 10.14.|

|ach |[ach](#achobject) |These are the details of the bank account used.|

|eft |[eft](#eftobject) |These are the details of the bank account used.|

|bacs |[bacs](#bacsobject) |These are the details of the bank account used.|

|sepa |[sepa](#sepaobject) |These are the details of the bank account used.|

|profile |[profile](#profileobject) |These are some details about the customer.|

|billingDetails |[billingDetails](#billingdetailsobject) |These are the billing details for the request.|

|shippingDetails |[shippingDetails](#shippingdetailsobject) |These are the shipping details for the request.|

|customerIp |string<br/>`length<=39` |This is the customer's IP address.|

|dupCheck |boolean |This validates that this request is not a duplicate. A request is considered a duplicate if the *merchantRefNum* has already been used in a previous request within the last 90 days.<br/>**Note:** This value defaults to *true*.|

|txnTime |UTC formatted date |This is the date and time the request was processed. For example:<br/>2017-01-26T10:32:28Z|

|currencyCode |string<br/>`length=3` |This is the currency of the merchant account, e.g., USD or GBP, returned in the request response. See [Currency Codes](#currencycodes)|

|error |[error](#errorobject) | |

|status |enum |This is the status of the transaction request. Possible values are:<ul><li>RECEIVED – Our system has received the request and is waiting for the downstream processor’s response.</li><li>PENDING – Our system has received the request but it has not yet been batched.</li><li>PROCESSING – The batching has started.</li><li>COMPLETED – The transaction has been completed.</li><li>FAILED – The transaction failed, due to either an error or being declined.</li><li>CANCELLED – The request has been cancelled.</li></ul>|

# Error Summary

<a name="commonerrors" title="Common Errors"></a>

## Common Errors

|HTTP Status Code |Error Code |Description|

|--- |--- |---|

|500 |1000 |An internal error occurred. |

|502 |1001 |An error occurred with the external processing gateway.|

|500 |1002 |An internal error occurred. |

|500 |1003 |An internal error occurred. |

|500 |1007 |An internal error occurred. |

|500 |1008 |An internal error occurred. |

|429 |1200 |The API call has been denied as it has exceeded the permissible call rate limit.|

|401 |5000 |Your merchant account authentication failed. Either your store ID/password are invalid or the IP address from which you are sending the transaction has not been authorized.|

|400 |5001 |The submitted currency code is invalid or your account does not support this currency.|

|400 |5003 |You submitted an invalid amount with your request.|

|400 |5004 |You submitted an invalid account type with your request.|

|400 |5005 |You submitted an invalid operation type with your request.|

|400 |5010 |The submitted country code is invalid.|

|400 |5016 |The merchant account you provided cannot be found.|

|400 |5017 |The merchant account you provided is disabled.|

|402 |5021 |Your transaction request has been declined.|

|400 |5023 |The request is not parseable.|

|409 |5031 |The transaction you have submitted has already been processed.|

|401 |5040 |Your merchant account is not configured for the transaction you attempted.|

|400 |5042 |The merchant reference number is missing or invalid or it exceeds the maximum permissible length.|

|400 |5068 |Either you submitted a request that is missing a mandatory field or the value of a field does not match the format expected.|

|404 |5269 |The ID(s) specified in the URL do not correspond to the values in the system.|

|403 |5270 |The credentials provided with the request do not have permission to access the requested data.|

|406 |5271 |You requested a response in the 'Accept' header that is in an unsupported format.|

|406 |5272 |The 'Content-Type' you specified in request header was submitted in an unsupported format.|

|404 |5273 |Your client reached our application but we were unable to service your request due to an invalid URL.|

|401 |5275 |The authentication credentials provided with the request have expired.|

|401 |5276 |The authentication credentials provided with the request provided have been disabled.|

|401 |5277 |The authentication credentials provided with the request have been locked due to multiple authentication failures.|

|401 |5278 |The authentication credentials provided with the request were not accepted for an unknown reason.|

|401 |5279 |The authentication credentials are invalid.|

|401 |5280 |The required authentication credentials were not provided.|

|405 |5281 |The request uses an action (e.g., GET, POST, or PUT) that is not supported by the resource.|

|400 |5502 |Either the payment token is invalid or the corresponding profile or bank account is not active.|

<a name="directdebiterrors" title="Direct Debit Errors"></a>

## Direct Debit Errors

|HTTP Status Code |Error Code |Description|

|--- |--- |---|

|400 |2004 |The Direct Debit transaction cannot be found. |

|400 |2011 |You have submitted a mandate reference that does not exist.|

|400 |2012 |You have submitted a mandate reference that is not active yet.|

|400 |2013 |The mandate reference does not have a valid status.|

|400 |2014 |The mandate reference is already in use for the specified bank account information.|

|400 |2017 |The payment token bank scheme does not match the merchant account bank scheme.|

|400 |2019 |The specified bank and account information is currently under INVALID state.|

|402 |4002 |The transaction was declined by our Risk Management department.|

<a name="directdebitreturncodes" title="Direct Debit Return Codes"></a>

## Direct Debit Return Codes

Occasionally, a Direct Debit API request will be successful, but can fail at the banking network level, e.g., due to insufficient funds or bank account closure. In such cases, the bank scheme provides a Return Code as an explanation. Because Direct Debit requests can take up to 7 days to clear, you cannot be notified of errors such as these via the API response.

However, you can use the [Paysafe Merchant Back Office](https://developer.paysafe.com/en/rest-apis/reference-information/managing-payments/paysafe-merchant-back-office/) to run reports to view Return Codes in the case where a Direct Debit request has failed.

| Code | Description | Bank Scheme |

|--------------|------------------------------------------------------------------------------------------------------------------------------------------------------------------|-------------|

| RT not found | | ACH |

| CONFIG | Client configuration problem | ACH |

| LIMIT | The maximum amount per check was exceeded. | ACH |

| INVACCT | Invalid account type. | ACH |

| INVDIR | Invalid direction. | ACH |

| NOPOP | Merchant not configured or not allowed to run POP transactions - Electronic Check Conversion. | ACH |

| PAPER | Paper draft and can't send paper. | ACH |

| PARSE | Parsing problem | ACH |

| THOMSON | Reject due to Thomson database. | ACH |

| UNKMER | Unknown merchant. | ACH |

| DEMO | Demonstration transaction/ or merchant. | ACH |

| R90 | Invalid MOD digit | ACH |

| R91 | Invalid ABA. Not nine (9) characters or numeric | ACH |

| R92 | ABA not active | ACH |

| R93 | Invalid Tran Code SEC combo | ACH |

| R94 | Invalid amount for pre-note Tran Code | ACH |

| R95 | Amount is zero (0) | ACH |

| R96 | Not a valid Tran code | ACH |

| R97 | Not a valid SEC code | ACH |

| R98 | Account decryption error | ACH |

| R99 | OFAC possible match | ACH |

| R37 | Source Document Presented for Payment | ACH |

| R38 | Stop Payment on Source Document | ACH |

| R39 | Improper Source Document | ACH |

| R53 | Item and ACH Entry Presented for Payment | ACH |

| R75 | Original Return not a Duplicate | ACH |

| R76 | No Errors Found | ACH |

| R83 | Foreign Receiving DFI Unable to Settle | ACH |

| R84 | Entry Not Processed by OGO | ACH |

| R01 | Insufficient funds | ACH |

| R02 | Account closed | ACH |

| R03 | No account/unable to locate | ACH |

| R04 | Invalid account number | ACH |

| R05 | Reserved | ACH |

| R06 | Return requested by ODFI | ACH |

| R07 | Authorization revoked Note 2 | ACH |

| R08 | Stop payment | ACH |

| R09 | Uncollected funds | ACH |

| R10 | Not authorizedNote 2 | ACH |

| R11 | Check truncation entry return | ACH |

| R12 | Branch sold to another DFI | ACH |

| R13 | RDFI not qualified to participate/or invalid route | ACH |

| R14 | Payee deceased | ACH |

| R15 | Beneficiary deceased | ACH |

| R16 | Account frozen | ACH |

| R17 | File record edit criteria | ACH |

| R18 | Improper effective entry date | ACH |

| R19 | Amount field error | ACH |

| R20 | Non transaction account | ACH |

| R21 | Invalid company ident. | ACH |

| R22 | Invalid individual ID number | ACH |

| R23 | Credit entry refused by receiver | ACH |

| R24 | Duplicate entry | ACH |

| R25 | Addenda error | ACH |

| R26 | Mandatory field error | ACH |

| R27 | Trace number error | ACH |

| R28 | Routing # check digit error | ACH |

| R29 | Corp cust. adviser not auth. | ACH |

| R30 | RDFI non-part truncation prob | ACH |

| R31 | Permissible return entry | ACH |

| R32 | RDFI non-settlement | ACH |

| R33 | Return of XCK entry | ACH |

| R34 | Limited participation DFI | ACH |

| R35 | Return of improper debit entry | ACH |

| R36 | Return of improper credit entry | ACH |

| R40 | Return of ENR entry by Fed. Gov. | ACH |

| R41 | Invalid transaction code | ACH |

| R42 | Routing #/check digit error | ACH |

| R43 | Inv. DFI acct. number | ACH |

| R44 | Inv. Individual ED number | ACH |

| R45 | Inv. individual name/company name | ACH |

| R46 | Inv. rep. payee indicator | ACH |

| R47 | Duplicate enrollment | ACH |

| R50 | State Law affecting RCK acceptance | ACH |

| R51 | Item is ineligible (RCK) | ACH |

| R52 | Stop payment on item (RCK) | ACH |

| R61 | Dishonor | ACH |

| R62 | Dishonor | ACH |

| R63 | Dishonor | ACH |

| R64 | Dishonor | ACH |

| R65 | Dishonor | ACH |

| R66 | Dishonor | ACH |

| R67 | Dishonor | ACH |

| R68 | Dishonor | ACH |

| R69 | Dishonor | ACH |

| R70 | Dishonor | ACH |

| R71 | ContestedNote 4 | ACH |

| R72 | ContestedNote 4 | ACH |

| R73 | ContestedNote 4 | ACH |

| R74 | ContestedNote 4 | ACH |

| R80 | Cross- border payment coding error | ACH |

| R81 | Non-participant in cross-border pgm. | ACH |

| R82 | Invalid foreign RDFI ID | ACH |

| YE | Transaction code unauthorised for originating Account | BACS |

| 0 | Refer to Payer | BACS |

| 1 | Instruction cancelled by payer | BACS |

| 2 | Payer Deceased | BACS |

| 3 | Account Transferred | BACS |

| 4 | Advance Notice Disputed | BACS |

| 5 | No Account | BACS |

| 6 | No Instruction | BACS |

| 7 | Amount Differs | BACS |

| 8 | Amount not yet due | BACS |

| 9 | Presentation Overdue | BACS |

| A | Service User Differs | BACS |

| B | Account Closed | BACS |

| E | Instruction amended | BACS |

| AE | Originating sort code and/or Account number invalid (bank originated) | BACS |

| BE | Originating sort code and/or Account number invalid (customer originated) | BACS |

| CE | Destination sort code and originating sort code and/or Account number invalid (bank originated) | BACS |

| DE | Destination sort code and originating sort code and/or Account number invalid (customer originated) | BACS |

| EE | Destination sort code invalid | BACS |

| FE | Account type and originating sort code and/or Account number invalid (bank originated) | BACS |

| GE | Account type and originating sort code and/or Account number invalid (customer originated) | BACS |

| HE | Destination sort code and Account type and originating sort code and/or Account number invalid (bank originated) | BACS |

| IE | Destination sort code and Account type and originating sort code and/or Account number invalid (customer originated) | BACS |

| JE | Destination sort code and Account type invalid | BACS |

| KE | Account type invalid | BACS |

| LE | Destination Account number and destination Account name and other fields invalid | BACS |

| ME | Destination Account number and destination Account name invalid | BACS |

| NE | Contra record was amended | BACS |

| OE | Reference number was invalid | BACS |

| PE | Originating Account does not support the file currency | BACS |

| QE | Automated reversal due to an error | BACS |

| RE | Reversal of another item (same day) | BACS |

| SE | Automated recall | BACS |

| TE | Originating Account invalid and was substituted with the default main Account details, but this Account does not support the file currency (customer originated) | BACS |

| UE | Unpaid direct debit reference was in error (bank originated) | BACS |

| XE | Originator's service user number invalid (bank originated) | BACS |

| ZE | Unpaid direct debit reference and other fields were in error (bank originated) | BACS |

| 1I | Amount and / or date of Direct Debit differ from Advance Notice | BACS |

| 2I | No Advance Notice received by Payer/or the amount quoted is disputed | BACS |

| 3I | DDI cancelled by paying bank | BACS |

| 4I | Payer has cancelled DDI direct with service user | BACS |

| 5I | AUDDIS service users only - No Instruction held. Payer disputes having given authority | BACS |

| 6I | AUDDIS service users only - Signature on DDI is fraudulent or not in accordance with account authorised signature(s) | BACS |

| 7I | Claim raised at service users request after Direct Debit applied to payers account | BACS |

| 8I | Service user name disputed. Payer does not recognise service user collecting Direct Debit | BACS |

| CC | Requested by originator | BACS |

| 0C | Invalid details | BACS |

| 2C | Beneficiary deceased | BACS |

| 3C | Account transferred | BACS |

| 5C | No account | BACS |

| BC | Account closed | BACS |

| C | Account transferred to a different branch of bank / building society | BACS |

| D | Advance notice disputed | BACS |

| F | Invalid account type | BACS |

| G | Bank will not accept Direct Debits on account | BACS |

| H | Instruction has expired | BACS |

| I | Payer reference is not unique | BACS |

| K | Instruction cancelled by paying bank | BACS |

| L | Incorrect payer's account details | BACS |

| M | Transaction code / user status incompatible | BACS |

| N | Transaction disallowed at payer's branch | BACS |

| O | Invalid reference | BACS |

| P | Payer's Name not present | BACS |

| Q | Service user's name blank | BACS |

| R | Instruction re-instated (maximum 2 months from original DDI cancellation date) | BACS |

| 900 | Validation Rejection | EFT |

| 901 | Not sufficient funds (debits only) | EFT |

| 902 | Cannot trace | EFT |

| 903 | Payment stopped/recalled | EFT |

| 904 | Post dated/stale dated | EFT |

| 905 | Account closed | EFT |

| 906 | Account transferred | EFT |

| 907 | No chequing privileges | EFT |

| 908 | Funds not cleared | EFT |

| 909 | Currency/Account Mismatch | EFT |

| 910 | Payor/payee deceased | EFT |

| 911 | Account frozen | EFT |

| 912 | Invalid/incorrect account number | EFT |

| 914 | Incorrect payor/payee name | EFT |

| 915 | Refused by payor/payee | EFT |

| 916 | Not in accordance with Agreement - Personal | EFT |

| 917 | Agreement Revoked - Personal | EFT |

| 918 | No Pre-Notification - Personal | EFT |

| 919 | Not in accordance with Agreement - Business | EFT |

| 920 | Agreement Revoked - Business | EFT |

| 921 | No Pre-Notification - Business | EFT |

| 922 | Customer Initiated Return Credit Only | EFT |

| 990 | Institution in Default | EFT |

| 998 | No Return Agreement | EFT |

| 4 | TRANSACTION TYPE is invalid or blank. See Appendix 3 for a list of CPA Transaction Types. | EFT |

| 5 | AMOUNT is blank, or not greater than zero. | EFT |

| 6 | DUE DATE is invalid or blank. | EFT |

| 7 | INSTITUTION (route and/or transit) is not in the correct format, does not exist or is blank. | EFT |

| 8 | ACCOUNT NUMBER is not a valid format for the specified INSTITUTION. | EFT |

| 9 | ITEM TRACE NO. is invalid. | EFT |

| 10 | STORED TRANSACTION TYPE is invalid or blank. | EFT |

| 11 | ORIGINATOR SHORT NAME is blank. | EFT |

| 12 | PAYOR/PAYEE NAME is blank. | EFT |

| 13 | ORIGINATOR LONG NAME is blank. | EFT |

| 14 | Originating Direct Clearer ID is invalid or blank. | EFT |

| 15 | CROSS REFERENCE is blank. | EFT |

| 16 | INSTITUTION FOR RETURNS (route and/or transit) is invalid or blank. It should specify your credit union. | EFT |

| 19 | Original item trace number is invalid or blank. | EFT |

| 21 | DATA ELEMENT ID is invalid or blank. | EFT |

| E | Accepted but errors were noted | EFT |

| M | Rejected, message authentication code (MAC) failed | EFT |

| P | Partially accepted, at least one transaction set was rejected | EFT |

| R | Rejected | EFT |

| W | Rejected, assurance failed validity tests | EFT |

| X | Rejected, content after decryption could not be analyzed | EFT |

| TR | Rejected by 824 | EFT |

| AC01 | Account identifier incorrect | SEPA |

| UPAY | Undue payment | SEPA |

| AC06 | Account blocked | SEPA |

| AC13 | Invalid debtor account type | SEPA |

| AG01 | Direct debit forbidden | SEPA |

| AG02 | Invalid bank operation code | SEPA |

| AGNT | Incorrect agent | SEPA |

| AM04 | Insufficient funds | SEPA |

| AM05 | Duplication | SEPA |

| BE04 | Missing creditor address | SEPA |

| BE05 | Unrecognized creditor | SEPA |

| CURR | Incorrect currency | SEPA |

| CUST | Recall by customer | SEPA |

| CUTA | Recall due to investigation request | SEPA |

| DT01 | Invalid date | SEPA |

| DUPL | Duplicate payment | SEPA |

| ED05 | Settlement failed | SEPA |

| FF01 | Invalid file format | SEPA |

| FF05 | Direct debit type incorrect | SEPA |

| FRAD | Fraud | SEPA |

| MD01 | No valid mandate | SEPA |

| MD02 | Mandate data missing or incorrect | SEPA |

| MD06 | Disputed authorized transaction | SEPA |

| MD07 | Debtor deceased | SEPA |

| MS02 | Refusal by debtor | SEPA |

| MS03 | Reason not specified | SEPA |

| PY01 | Not routable | SEPA |

| RC01 | Bank identifier incorrect | SEPA |

| RR01 | Missing debtor account or identification | SEPA |

| RR02 | Missing debtor name or address | SEPA |

| RR03 | Missing creditor name or address | SEPA |

| RR04 | Regulatory reason | SEPA |

| SL01 | Specific service offered by debtor agent | SEPA |

| TECH | Payment in error due to technical problem | SEPA |

| TM01 | Invalid cut off time | SEPA |

| AC04 | Account closed | SEPA |

# Using the Example API Calls (Console Window)

To configure and test the API examples, first click on one of the API calls in the API Reference section and then click **Switch to Console** in the right hand pane.

Using the Console window you can update the headers, the request body, and parts of the API endpoint.

For example, for many requests you must update the endpoint to include your account ID, which you do by selecting **URI Parameters** and then updating the **ACCOUNT_ID** value.

(To get your account ID, log into the Paysafe Back Office, choose **Accounts** and look in the *Account* column). You must choose an account which has been enabled for the direct debit method

you wish to use. You must also update the Header to include your API Key by selecting **Headers** and then updating the **Authorization** value using the Base64

version of your API key. To get your API key, log into the test version of the Merchant Back Office and choose **Settings > API Key**.

Click *View Base 64 Encoded* and copy the key to your clipboard. Paste the key after the word Basic to replace the text YOUR-BASE64-ENCODED-API-KEY.

When you are ready to test your example, you can choose between the Production and Mock server environment:

* Production server – This calls the resource on Paysafe's Test system.

* Mock server – This environment simply returns the dummy values in the example response irrespective of the parameters you supply. You do not need to use your account ID or Test API key for this request.

To call the API resource, click **Call Resource**. The response is displayed in the Console window.

# Legal and Community

<ul>

<li><a href="https://www.paysafe.com/paysafegroup/privacy-policy/" target="_blank">Privacy Policy</a></li>

<li><a href="https://developer.paysafe.com/en/resources-and-support/terms-of-use/" target="_blank">Terms of Use</a></li>

<li><a href="https://www.paysafe.com/paysafegroup/regulatory-disclosures/" target="_blank">Regulatory Disclosures</a></li>

</ul>

## Verify That the Service Is Accessible [GET /monitor]

<a name="verifyservice" title="Verify Service"></a>

This call returns a status of READY if the API is available.

+ Response 200 (application/json)

+ Body

{

"status" : "READY"

}

# Purchases [/purchases]

<a name="purchaserequest" title="Purchase Request"></a>

## ACH Purchase [POST /v1/accounts/{account_id}/purchases]

<a name="achpurchaserequest" title="ACH Purchase Request"></a>

This shows you four examples of an ACH Purchase request:

* A regular Purchase request

* A Purchase request including [Split Payouts](https://developer.paysafe.com/en/rest-apis/platforms/split-payouts/split-payouts-overview/)

* A Purchase request using a payment token

* A Purchase request using a single-use token that also creates a permanent, reusable payment token representing the ACH account

In the case of a Purchase request using a payment token, you can use either of two payment token types:

* The permanent, reusable payment token that you receive in the response to a Customer Vault [ACH bank account creation request](https://developer.paysafe.com/en/vault/api/#/reference/0/ach-bank-accounts/create-an-ach-bank-account)

* The temporary payment token that you receive in the response to a Customer Vault [ACH single-use token creation request](https://developer.paysafe.com/en/vault/api/#/reference/direct-debit-single-use-tokens/direct-debit-single-use-tokens/create-an-ach-single-use-token)

+ Parameters

+ account_id:123456789 (string, required) - This is the merchant account number.

+ Attributes

+ Include Purchase Base

+ Include ACH

+ Include profile

+ Include billingDetails

+ Include Splitpay Request

+ Include links

+ Request Submit an ACH Purchase Request (application/json)

+ Headers

Authorization: Basic YOUR-BASE64-ENCODED-API-KEY

+ Body

{

"merchantRefNum": "04.04.17_2",

"amount": 10155,

"customerIp": "192.0.126.111",

"ach": {

"accountHolderName": "First Company",

"accountType": "SAVINGS",

"payMethod": "WEB",

"accountNumber": "998772192",

"routingNumber": "211589828",

"paymentDescriptor": "Transaction"

},

"profile": {

"firstName": "John",

"lastName": "Johnson",

"email": "[email protected]",

"ssn": "123456789",

"dateOfBirth": {

"day": 24,

"month": 10,

"year": 1981

}

},

"billingDetails": {

"street": "100 Queen Street West",

"street2": "Apt. 55",

"city": "Ottawa",

"state": "ON",

"country": "CA",

"zip": "M1M 1M1",

"phone": "6139991100"

}

}

+ Response 200 (application/json)

+ Body

{

"merchantRefNum": "04.04.17_2",

"amount": 10155,

"ach": {

"lastDigits": "92",

"accountHolderName": "First Company",

"accountType": "SAVINGS",

"payMethod": "WEB",

"paymentDescriptor": "Transaction",

"routingNumber": "211589828",

"accountNumber": "*******92"

},

"profile": {

"firstName": "John",

"lastName": "Johnson",

"email": "[email protected]",

"ssn": "*******89",

"dateOfBirth": {

"year": 1981,

"month": 10,

"day": 24

}

},

"billingDetails": {

"street": "100 Queen Street West",

"street2": "Apt. 55",

"city": "Ottawa",

"state": "ON",

"country": "CA",

"zip": "M1M 1M1",

"phone": "6139991100"

},

"customerIp": "192.0.126.111",

"dupCheck": true,

"id": "7afd1d4a-39b8-4756-ba58-d886ad4aa35c",

"txnTime": "2017-04-04T13:35:17Z",

"currencyCode": "USD",

"status": "COMPLETED",

"links": [{

"rel": "self",

"href": "https://api.test.paysafe.com/directdebit/v1/accounts/1001058140/purchases/7afd1d4a-39b8-4756-ba58-d886ad4aa35c"

}]

}

+ Request Submit an ACH Purchase Request with Split Payouts (application/json)

+ Headers

Authorization: Basic YOUR-BASE64-ENCODED-API-KEY

+ Body

{

"merchantRefNum": "04.04.17_2",

"amount": 10000,

"customerIp": "192.0.126.111",

"ach": {

"accountHolderName": "First Company",

"accountType": "SAVINGS",

"payMethod": "WEB",

"accountNumber": "998772192",

"routingNumber": "211589828",

"paymentDescriptor": "Transaction"

},

"profile": {

"firstName": "John",

"lastName": "Johnson",

"email": "[email protected]",

"ssn": "123456789",

"dateOfBirth": {

"day": 24,

"month": 10,

"year": 1981

}

},

"billingDetails": {

"street": "100 Queen Street West",

"street2": "Apt. 55",

"city": "Ottawa",

"state": "ON",

"country": "CA",

"zip": "M1M 1M1",

"phone": "6139991100"

},

"splitpay": {

"linkedAccount": "123124124",

"percent": 5

}

}

+ Response 200 (application/json)

+ Body

{

"merchantRefNum": "04.04.17_2",

"amount": 10155,

"ach": {

"lastDigits": "92",

"accountHolderName": "First Company",

"accountType": "SAVINGS",

"payMethod": "WEB",

"paymentDescriptor": "Transaction",

"routingNumber": "211589828",

"accountNumber": "*******92"